Click to Skip Ahead

Note: This article’s statistics come from third-party sources and do not represent the opinions of this website.

Although pet insurance isn’t a legal requirement in the UK, it does cover the cost of unexpected illnesses as well as injuries caused by accidents and other incidents. Depending on the policy it can protect pets for vet visits, tests, treatment, and aftercare totalling thousands of pounds every year. Policy terms and premiums do vary but the annual premium typically costs a couple of hundred pounds per pet, and there are discounts available for multi-pet policies.

Despite the benefits, according to some studies, just 10% of the country’s owners have insurance policies for their furry friends, despite owners paying more than £5 billion a year on vet bills. Although the majority of insurance products in the UK are for cats and dogs, rabbit policies are also available, and there is a growing number of exotic pet insurance policies, although it is still difficult to find competitive policies for these unusual pets.

Below, you can find 13 statistics related to the UK pet insurance market including figures on costs and the potential savings they could make owners.

The 13 UK Pet Insurance Statistics

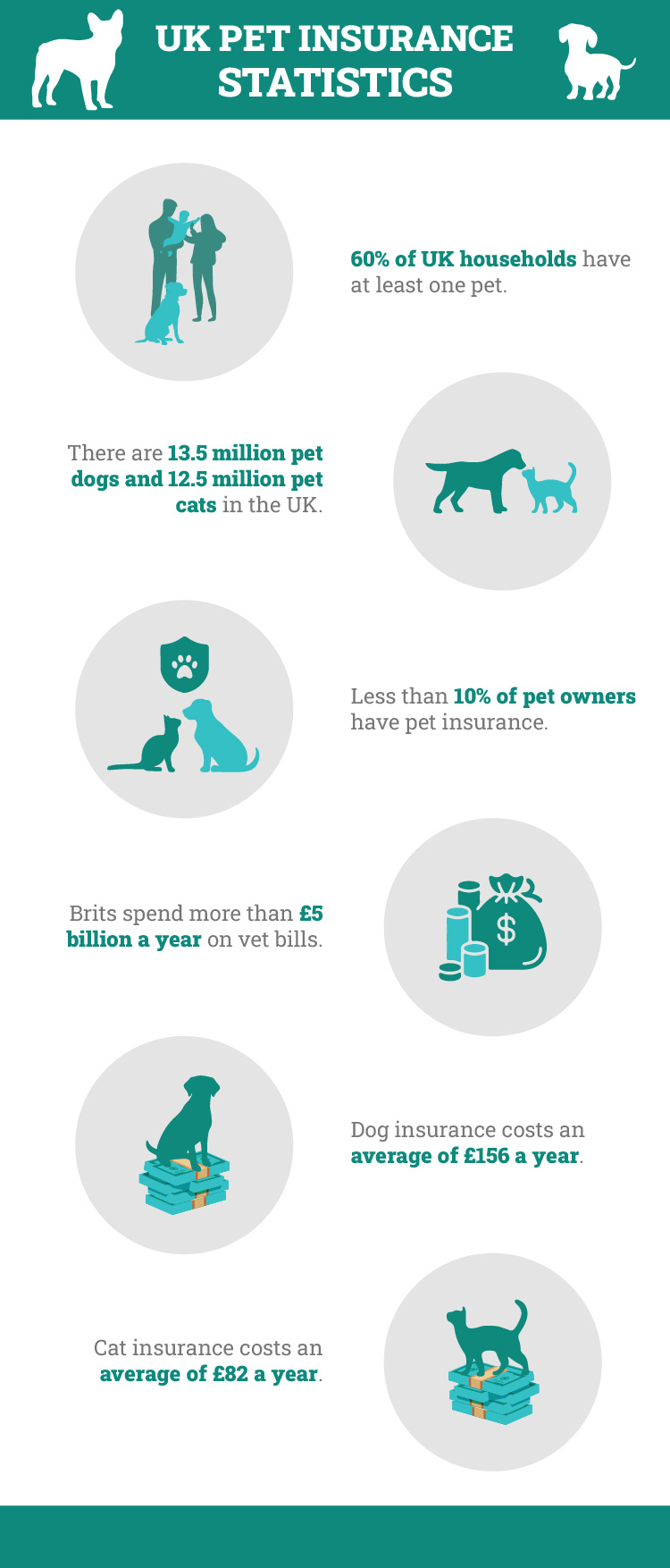

- 60% of UK households have at least one pet.

- There are 13.5 million pet dogs and 12.5 million pet cats in the UK.

- Less than 10% of pet owners have pet insurance.

- Brits spend more than £5 billion a year on vet bills.

- Vet bill expenditure has more than doubled in the past 10 years.

- Veterinary costs rose by 17% in 2023.

- UK pet owners submit more than a million pet insurance claims a year.

- Pet insurance policies pay out more than a billion a year.

- 72% of pet owners with a household salary of £60,000 or more have pet insurance.

- Dog insurance costs an average of £156 a year.

- Cat insurance costs an average of £82 a year.

- Rabbit insurance costs around £180 a year.

- More than a fifth of pet owners feel pet insurance isn’t worth the cost.

Pet Population

1. 60% of UK households have at least one pet.

(UK pet Food)

The UK loves its pets, as is evident from the fact that 60%, or 6 in 10, households have at least one pet. The number of households keeping pets increased substantially in 2019 and 2020, although the populations have levelled off since the end of the pandemic.

As people have gone back to work in offices and do not spend as long at home, and as the cost-of-living crisis has hit, many owners find they are no longer able to properly care for their pets anymore.

2. There are 13.5 million pet dogs and 12.5 million pet cats in the UK.

(UK pet Food)

Dogs and cats are the most popular pets. Although it is difficult to determine exact figures, there are believed to be 13.5 million pet dogs and a further 12.5 million pet cats in the country. Pet owners also keep a total of 1.5 million indoor birds and 1.3 million domestic fowl.

There are an estimated 1 million pet rabbits as well as 700,000 tortoises and turtles, and a similar number of horses and ponies. Guinea pigs and hamsters also have a population of approximately 700,000 each, although the population of small animals has risen sharply in the past year.

Insurance policies are common for dogs and cats, available for rabbits, and are also popular for horses, but are much less common for other species of pets.

3. Less than 10% of pet owners have pet insurance.

(Go Compare)

In total, less than 1 in 10 UK owners have pet insurance policies. However, this figure does include the owners of several million small animals and other species that are difficult to insure because of a lack of availability of insurance products.

A pet owner might have more than one insured pet, so considering just dogs, cats, and rabbits, it is likely that more than 10% of the total population is insured.

Vet Bills

4. Brits spend more than £5 billion a year on vet bills.

(Statista)

All pet owners hope their pets will never have to visit the vet except for regular checkups and routine, planned treatment. In reality, however, vet visits are more common than any of us would like.

In total, Brits spend more than £5 billion a year on vet bills. This figure includes everything from routine checkups to elective procedures. A lot of these procedures would not be covered even by valid insurance policies, as procedures like neutering are not included, while some policies do not cover dental work.

Owners should always check policy details and terms to ensure they get the level and type of coverage they require for their pets.

5. Vet bill expenditure has more than doubled in the past 10 years.

(Statista)

The UK government announced in 2024 that it was undertaking a full investigation into the vet industry and, in particular, the costs associated with visiting the vet. Many owners complain that the costs of visiting the vet are prohibitively high.

As well as paying for treatment and prescriptions, owners also have to cover the high costs of X-rays, scans, and other tests. In the past 10 years, expenditure on veterinary services in the UK has more than doubled to its current level.

6. Veterinary costs rose by 17% in 2023.

(Insurance Times)

Veterinary costs have risen sharply in the past 12 to 24 months with reports showing that prices rose 17% in 2023 alone. At the same time, insurance premiums also rose but only by around 12%, which means insurance enjoyed net benefits during that time.

Although some of the veterinary increases can be credited to a rise in material cost, the increase is considerably higher than inflationary increases.

Insurance Statistics

7. UK pet owners submit more than a million pet insurance claims a year.

(ABI)

Pet insurance policies can cover the medical costs of unexpected illnesses as well as injuries caused by accidents and other incidents. They don’t cover elective procedures, which include neutering even though this can prolong the life of your pet and help ensure that they don’t develop certain types of cancer later in life.

While these aren’t covered by insurance, you might find that you receive lower premiums if your pet has been spayed or castrated.

8. Pet insurance policies pay out more than a billion a year.

(ABI)

Pet insurance policies can seem expensive, especially when looking at the annual premium. And, if owners don’t make any claims on those policies, the premiums can seem extremely high.

However, pet insurance pays out, on average, more than a billion pounds a year, which means it does pay for a lot of emergency procedures, operations, prescriptions, and tests.

9. 72% of pet owners with a household salary of £60,000 or more have pet insurance.

(SagaCity)

Cost is the most common reason that owners choose not to take out pet insurance. Annual premiums can total £200 a year or more for some pets, which is a lot of money if the pet in question doesn’t need treatment of any sort. As such, pet owners with more disposable income are those who are the most likely to take out insurance.

According to one study, more than 7 in 10 pet owners with an annual household salary of £60,000 or more have insurance in place for their pets.

Insurance Costs

10. Dog insurance costs an average of £156 a year.

(Compare The Market)

Insurance prices vary according to where in the country the policyholder lives, as well as the type, breed, and age of the pet. Dogs typically require more veterinary visits and, when they do visit the vet, the cost of treatment is usually higher than with other animals.

As such, they attract higher annual premiums than cats. The average annual cost of a dog insurance policy is £156 a year.

11. Cat insurance costs an average of £82 a year.

(Compare The Market)

Cats typically have less need for veterinary care over the course of their life, or cat owners are less likely to take their cats to the vet for treatment. In either case, insurers offer cat insurance for lower premiums than they do dog insurance.

The average annual cost of a cat insurance policy is just £82 a year.

12. Rabbit insurance costs around £180 a year.

(Nimble Fins)

Size isn’t everything when it comes to insurance costs. Rabbit insurance is available but only from a relatively select number of insurers. This scarcity means that rabbit insurance prices are higher not only than cat insurance policies but also dog insurance products. Rabbit owners pay, on average, £180 a year for their insurance.

Although rabbits are lower maintenance pets than cats and dogs, they are prone to a number of health conditions and they can live quite long lives, which means their vet bills add up to a surprisingly high amount over a lifetime, hence the higher costs.

13. More than a fifth of pet owners feel pet insurance isn’t worth the cost.

(Go Compare)

Despite the potential benefits of pet insurance, many owners clearly choose not to take out policies for their pets, including for dogs, cats, and rabbits. When asked, the main reason given by 24% of uninsured pet owners is that it does not offer value for money.

Another common reason that owners do not have pet insurance is the basic cost. The owner might see that insurance offers value for money but they don’t have the disposable income to pay for a policy every month, or every year.

Frequently Asked Questions (FAQ)

Do pets have to be insured?

There is no law or regulation dictating that UK pets have to be insured, in general. However, recent legislation has banned the ownership of XL Bully breeds, except where owners have an exemption. To gain exemption, the dog must be insured as well as neutered, microchipped, and muzzled when in public.

Does pet insurance cover neutering and microchipping?

Pet insurance does not cover elective procedures. Some policies might include microchipping as a bonus meant to attract new customers, and policies are typically cheaper if dogs have been neutered, but these are elective procedures and, as such, they are not covered by standard policies.

Similarly, flea and worm treatments are not covered by accident and illness policies, but wellness policies might offer some money off these preventive treatments.

Does pet insurance cover existing illnesses?

Most pet insurance policies exclude existing illnesses, which means if you swap policies or take out a first policy, anything that has been diagnosed and treated by a vet previously will not be covered by the policy terms. However, there are some instances where existing illnesses might be covered.

Some policies offer coverage if a pet has been symptom-free for a given period, typically between 12 and 24 months. And, some policies might continue covering a condition when an owner swaps to a new insurer. Owners should always check the terms and conditions, especially exclusions, when choosing pet insurance.

Can you get pet insurance for pets other than cats and dogs?

Cats and dogs are the most commonly kept pets in the UK with a combined population of more than 25 million. As such, most insurance companies only cover these types of animals. However, it is possible to find some insurers that will protect rabbits and even exotic pets, while horse insurance policies are available from specialist insurers.

What affects the cost of pet insurance?

Many factors affect the cost of pet insurance. The age of the pet has a big influence on price, along with the species and breed of pet. Even the pet’s location and the type of property they live in also play a part in determining premium price.

Owners should shop around to get the best deal while ensuring that the policy offers an appropriate level of coverage and has attractive terms and conditions.

What are the most expensive dog breeds to insure?

Giant breeds and those that are more prone to hereditary conditions and injuries are usually the most expensive to insure. The Bernese Mountain Dog, Doberman, and Newfoundland breeds work out to be the most expensive breeds, on average.

(Insurance Business Mag)

Conclusion

Pet insurance gives peace of mind to owners because it covers the cost of vet bills that arise from unexpected illnesses as well as injuries caused by accidents. Policies can pay out thousands of pounds in some cases. And, in these cases, the £150 a year policy premium represents very good value for money.

Despite this, some estimates suggest that just 10% of pet owners have insurance policies, although this figure does include owners of pets that are difficult to insure because of a lack of availability of viable policies.